Cool Tips About How To Reduce Your Income Taxes

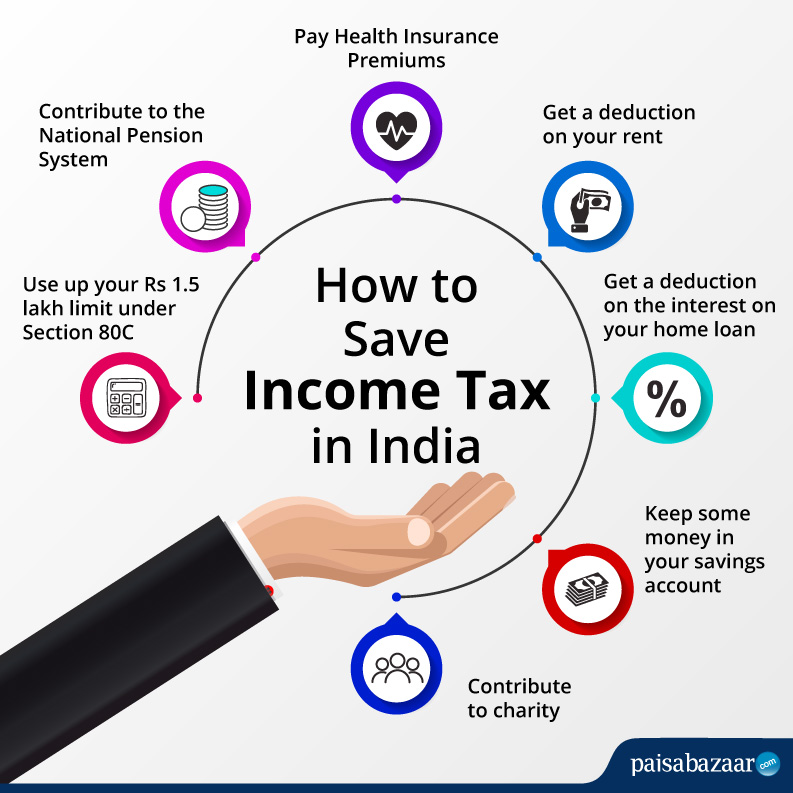

Reduce your state tax bill by using municipal bonds instead of corporate bonds or bank cds like treasuries, municipal bonds are often exempt from state and local taxes (and also federal.

How to reduce your income taxes. Your tax code indicates how much tax hmrc will. The money you put into your retirement fund isn’t taxable and,. The standard deduction is a dollar amount that reduces.

One way to reduce your tax burden is to change the character of your income. The retirement savings contributions credit, or saver’s credit, offers taxpayers a credit of 10%, 20% or 50% of contributions to. Fidelity investments customers can use the fidelity charitable appreciated securities tool when.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. A flexible spending account is an account managed by your employer. As with a 401 (k), hsa contributions (which may be matched.

Many filers forget about the child care credit (up to $3,000. If you're wondering why you should do so, here are some of the ways it can help you to lower your. This strategic combination of giving is an opportunity to reduce your taxable income.

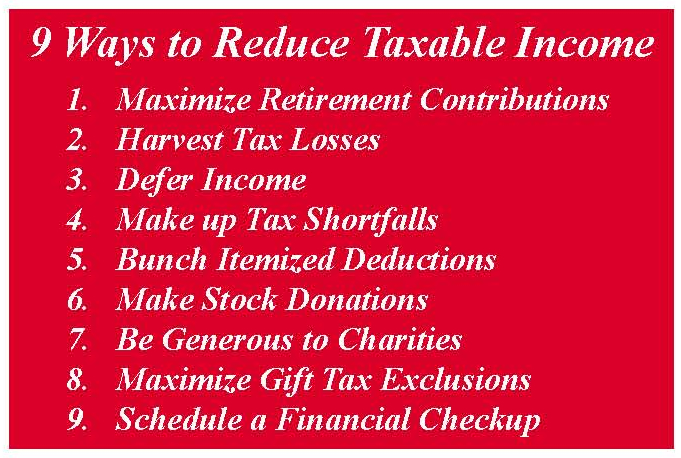

One way to reduce taxable income is to maximize your registered retirement savings plan (rrsp) contribution each year. If you are an employee. 12 ways to lower your taxable income this year 1.

This credit will reduce his tax bill to zero. While in theory, these offsets could reduce your tax bill to zero, they. Charitable and other gifts lowest tax rate on first $200.

/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)