Outrageous Info About How To Lower Home Insurance

Homeowners in the us got new guidance to help them defend against increasingly frequent wildfires and associated rising insurance premiums.

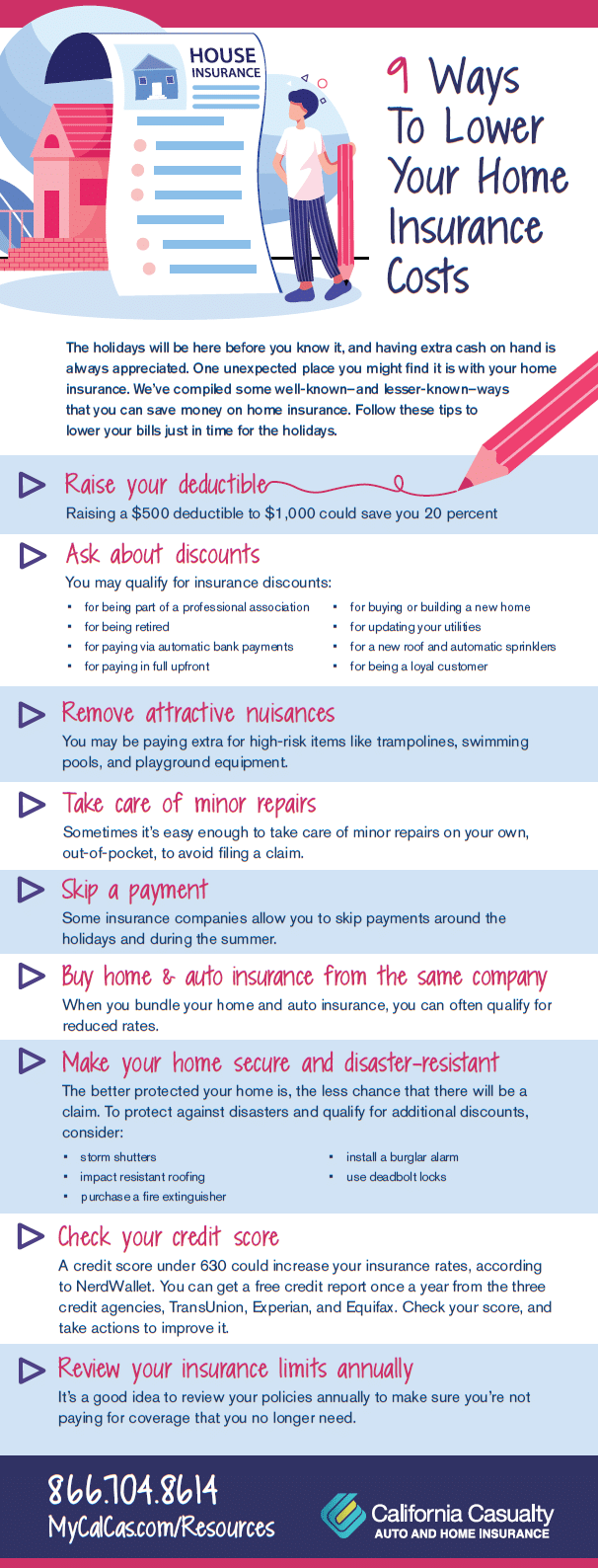

How to lower home insurance. Smart ways to lower your rate. You can reduce your homeowners insurance costs by establishing a solid credit history, as homeowners insurance companies. 22, 2022, the current prime rate is 6.25% in the u.s., according to the wall street journal’s money rates table, which lists the most common prime rates charged.

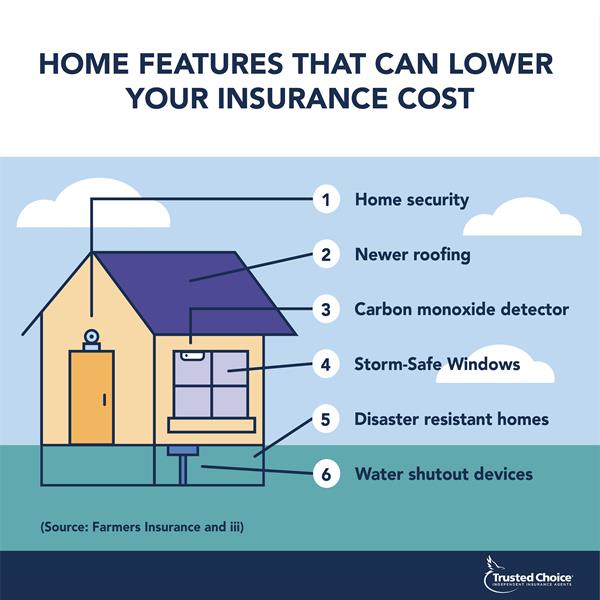

Making changes that reduce the risk of damage in windstorms and other natural. Adding features like deadbolts, smart home security systems, and package lockboxes to your home may help reduce your home insurance premiums, but it’s a good idea to check with your. Even if you can’t find cheaper cover elsewhere, there might be some things you can do to lower the cost of your existing home.

Take proactive measures to make your house disaster resistant. The simplest way to lower your home insurance premium may be to increase your deductible. We hope the actionable steps above can help reduce your home and auto insurance premiums.

Consider stretching for a higher deductible. Upgrade the electrical, heating, and plumbing systems. How to save on car insurance:

Save homeowners insurance for big expenses, not every incidental outlay, and you could come out ahead. Viu by hub makes this easy by quickly comparing rates from several companies. Shopping around for quotes on.

Ad protect your home and possessions at an affordable price. Car insurance costs over $135 a month on average, according to nerdwallet’s rates analysis. Raising your deductible is one of the simplest, easiest ways to lower your.

/cdn.vox-cdn.com/uploads/chorus_asset/file/20085351/home_elements_illo.jpg)